Know Your Customer (KYC) regulations, often hailed as a necessary tool to combat money laundering and financial crimes are in reality a deeply flawed and intrusive system. At its core, KYC requires individuals to submit sensitive personal information to financial institutions to “prevent” illegal activities. However this practice has significant drawbacks, infringing on privacy rights and failing to achieve its stated goals.

KYC mandates the collection of vast amounts of personal data, including identification documents, financial history and even biometric information. This level of scrutiny is not only invasive but also places individuals at risk of data breaches. Financial institutions and third-party providers are frequent targets of cyberattacks and when such data is compromised, the consequences for individuals are severe — like identity theft, financial fraud and a loss of personal privacy with possible scary outcomes as already seen.

Despite the widespread implementation of KYC, the system has proven largely ineffective in combating money laundering and financial crimes. Criminals and corrupt entities find ways to circumvent these regulations through sophisticated networks and loopholes, while ordinary citizens bear the brunt of increased surveillance and reduced financial freedom. In many cases KYC procedures only create unnecessary barriers for legitimate transactions, disproportionately affecting marginalized communities and small businesses.

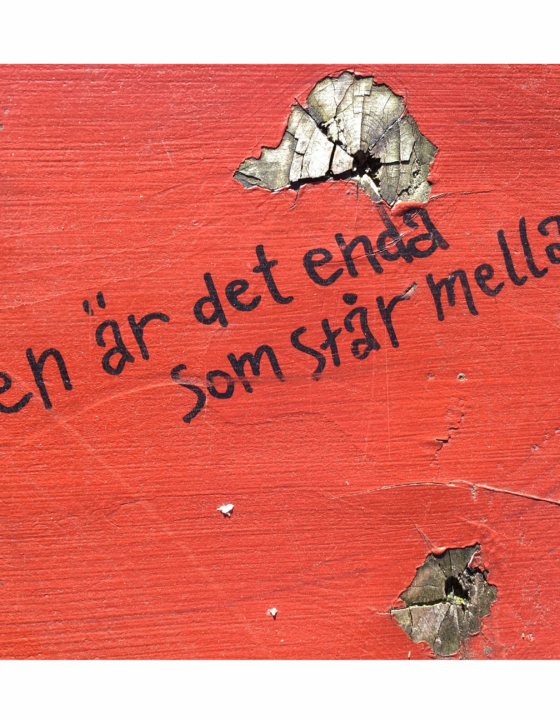

It’s about controlling you, not protecting you.

While KYC regulations impose strict scrutiny on individual financial activities, governments themselves often engage in dubious financial practices. Some governments funnel money to support conflicts or provide weapons to open genocides — without scrutiny. The real threat lies not in the transactions of ordinary people, but in the unchecked power of those who enforce these regulations.

What do you think?